Deciding to move into an aged care home is often a challenging and emotional decision for the person moving and their loved ones.

Many things need to be taken care of, like choosing the right aged care facility, financing the costs of aged care and deciding what to do with the family home.

The financial implications of these decisions can have a significant impact on what you pay, how care is funded, your entitlements as well as impact on assets as they transfer to the next generation.

Your adviser will guide you through a defined process to help you make the right financial decisions when entering aged care.

Your adviser will work with you to help you:

- Understand how the aged care system works

- Understand your options

- Choose the aged care option that best meets your needs

- Employ the best strategies to help reduce the cost of aged care.

When thinking about aged care, it’s also important to know what to look for when that time comes. Our blog “Retirement villages: look beyond the brochure” is a must read for anyone looking at aged care for themselves or their loved ones.

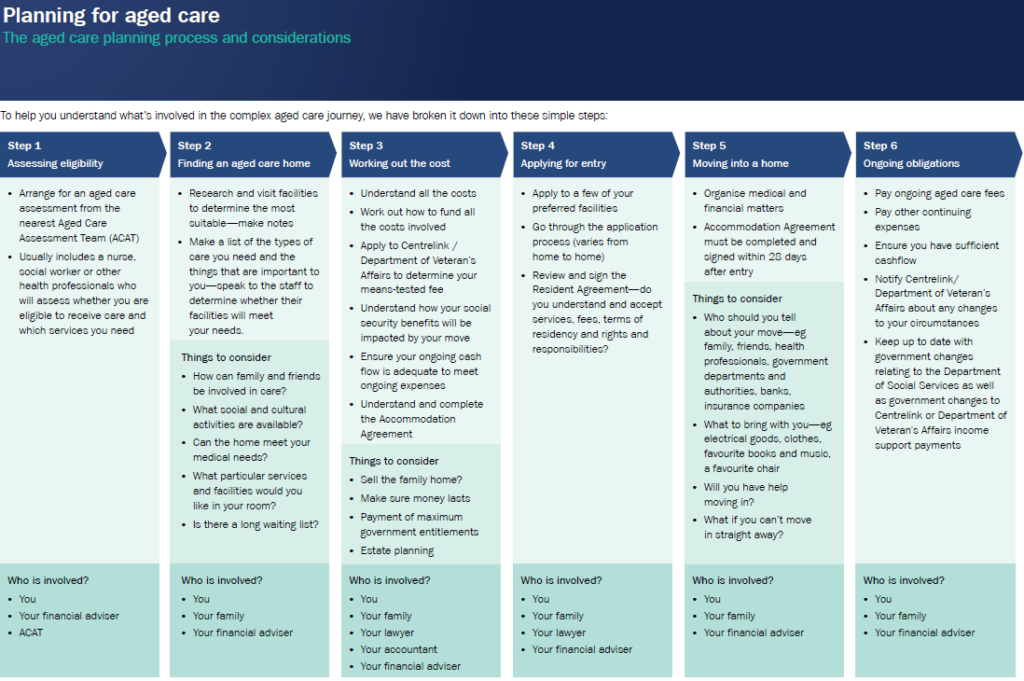

The aged care planning process and consideration

To help you understand what’s involved in the complex aged care journey, we have broken it down into these simple steps to help guide you.

Click here or on the image to view in full detail.

Any advice in this document is of a general nature only and has not been tailored to your personal circumstances. Accordingly, reliance should not be placed on the information contained in this document as the basis for making any financial investment, insurance or other decision. Please seek personal financial, tax and legal advice prior to acting on this information. Opinions constitute our judgement at the time of issue and are subject to change. No member of the NAB Group, nor their employees or directors, gives any warranty of accuracy, nor accepts any responsibility for errors or omissions in this document.