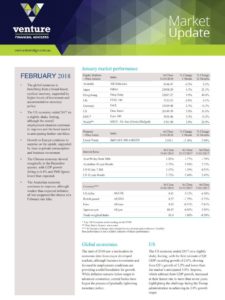

The pulse

- The global economy is benefiting from a broad based, cyclical recovery, supported by higher levels of investment and accommodative monetary policy

- The US economy ended 2017 on a slightly shaky footing, although the overall employment situation continues to improve and the bond market is anticipating further rate hikes

- Growth in Europe continues to surprise on the upside, supported by rises in private consumption and business investment

- The Chinese economy slowed marginally in the December quarter, with GDP growth falling to 6.8% and PMI figures lower than expected

- The Australian economy continues to improve, although weaker than expected inflation all but scuppered the chance of a February rate hike.

Global economies

The start of 2018 saw a moderation in economic data from major developed markets, although business investment and favourable employment conditions are providing a solid foundation for growth. While inflation remains below target in advanced economies, central banks have begun the process of gradually tightening monetary policy.

Australia

The economic outlook for Australia has improved in recent months with evidence of a recovery in business investment now complementing the very strong labour market and business conditions data. The RBA’s February monetary policy statement was undeniably more bullish compared to its December release, but nevertheless the board opted to keep the cash rate on hold at 1.50%, with inflation still low but expected to move higher.

US

The US economy ended 2017 on a slightly shaky footing, with the first estimate of Q4 GDP recording growth of 2.6%, slowing from Q3’s growth of 3.2% and lower than the market’s anticipated 3.0%. Imports, which subtract from GDP growth, increased at their fastest rate in more than seven years, highlighting the challenge facing the Trump administration in achieving its 3.0% growth target.

Europe

Euro area GDP grew by 0.6% in Q4 (2.7% year-on-year), slightly lower on Q3’s growth of 0.7% (2.8% year-on-year). Recent survey data shows that manufacturing is growing at the fastest rate in over two decades, while the services sector enjoyed its best year since 2007. Major European shares leapt to record earnings early in 2018, despite a rising euro and falling US dollar. However, the eurozone may become a victim of its own success if the currency rises too quickly.

Asia region

The latest Nikkei Manufacturing PMI survey for the Asia region (excluding mainland China) showed a strong start to 2018. Nine of the 11 Asian economies surveyed saw an expansion of manufacturing activities in the month, with the ASEAN region returning to growth after contracting at the end of 2017.

China

The Chinese economy slowed marginally in the December quarter, with GDP growth falling to 6.8% after averaging 6.9% in the first three quarters of 2017. A clampdown on factory pollution, a further lift in borrowing rates, and tighter financial conditions in the shadow banking sector are likely to have dampened growth.