The Pulse

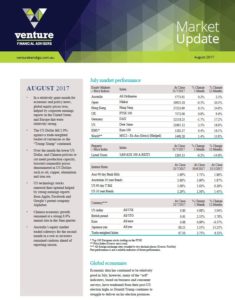

- In a relatively quiet month for economic and policy news, global equity prices rose, helped by corporate earnings reports in the United States and Europe that were relatively strong.

- The US Dollar fell 2.9% against a trade weighted basket of currencies as the “Trump Slump” continued.

- Over the month the lower US Dollar, and Chinese policies to cut metal production capacity, boosted commodity prices denominated in US Dollars such as oil, copper, aluminium and iron ore.

- US technology stocks renewed their uptrend helped by strong earnings reports from Apple, Facebook and Google’s parent company Alphabet.

- Chinese economic growth remained at a strong 6.9% annual rate in the June quarter.

- Australia’s equity market traded sideways for the second month in a row as investors remained cautious ahead of reporting season.

Global economies

Economic data has continued to be relatively good in July, however, many of the “soft” indicators, based on business and consumer surveys, have weakened from their post-US election highs as Donald Trump continues to struggle to deliver on his election promises.

Australia

In Australia, most of the data released in the past month has been in line with expectations, which usually means that it has followed recent trends. The unemployment rate remained stable at 5.6% in June, the core annual rate of inflation was stable at 1.8% in the June quarter and the RBA kept interest rates on hold in early August.

US

GDP figures for the June quarter confirmed that the US economy continues to grow at around 2% per annum, well below the 3% level targeted by Donald Trump and below the levels suggested by business and consumer surveys in early 2017.

Europe

In the Eurozone, economic growth rates have picked up from 1.9% year-on-year in the March quarter to 2.1% in the June quarter and unemployment has declined further, now at 9.1%, which is the lowest since the global financial crisis. Against this backdrop, the European Central Bank has dropped its reference to “downside risks” in its outlook for the European economy and this allows it to gradually move towards tapering of its €60 billion per month in asset purchases later this year with interest rate rises in 2018.

China

Chinese data released over the past month has shown that the economy there continues to perform relatively well with stable annual growth of 6.9% in the June quarter, supported by property and infrastructure construction. Other indicators such as industrial production, international trade, retail sales and fixed asset investment also paint a picture of an economy that is performing well.

Asia Region

In Japan, the consumer price index rose an as expected 0.4% year-on-year in June, however, the Bank of Japan’s preferred measure of core annual inflation remained stuck at zero for the third consecutive month. Meanwhile the June employment report in Japan remained strong, with the unemployment rate falling back down to 2.8% after being a little higher in June.

To read the full Market Update click here.