The pulse

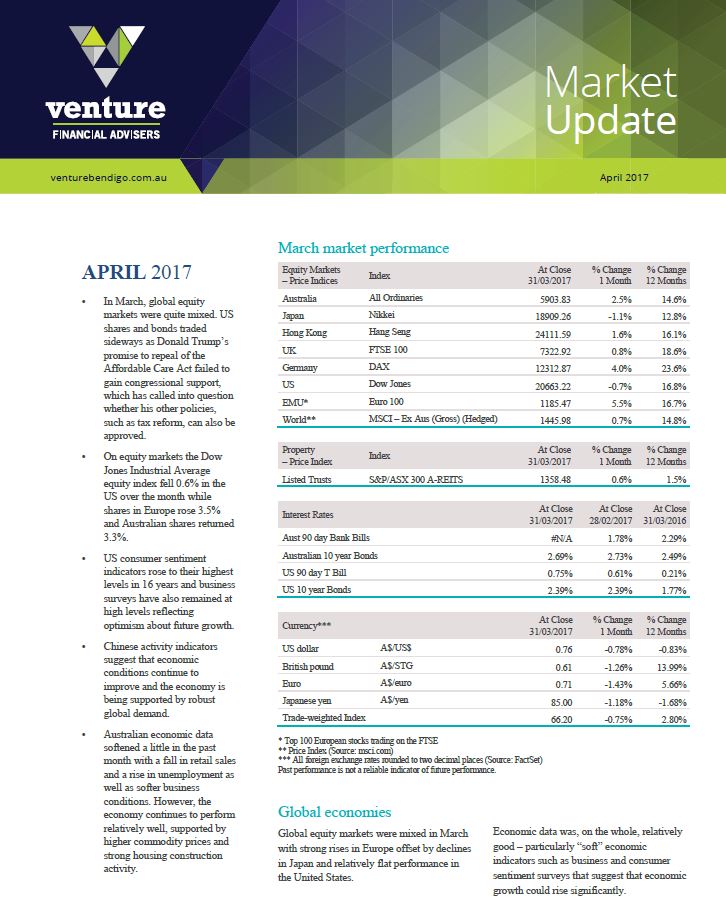

- In March, global equity markets were quite mixed. US shares and bonds traded sideways as Donald Trump’s promise to repeal of the Affordable Care Act failed to gain congressional support, which has called into question whether his other policies, such as tax reform, can also be approved.

- On equity markets the Dow Jones Industrial Average equity index fell 0.6% in the US over the month while shares in Europe rose 3.5% and Australian shares returned 3.3%.

- US consumer sentiment indicators rose to their highest levels in 16 years and business surveys have also remained at high levels reflecting optimism about future growth.

- Chinese activity indicators suggest that economic conditions continue to improve and the economy is being supported by robust global demand.

- Australian economic data softened a little in the past month with a fall in retail sales and a rise in unemployment as well as softer business conditions. However, the economy continues to perform relatively well, supported by higher commodity prices and strong housing construction activity.

Global economies

Global equity markets were mixed in March with strong rises in Europe offset by declines in Japan and relatively flat performance in the United States. Economic data was, on the whole, relatively good – particularly “soft” economic indicators such as business and consumer sentiment surveys that suggest that economic growth could rise significantly.

US

In the US, the Federal Reserve increased the Fed Funds Target range from 0.50 -0.75% to 0.75 – 1.00% per annum, as expected, and subsequent speeches from Federal Reserve Open Markets committee members suggested that two to three more rate rises are likely in 2017.

Europe

In the Eurozone, the aggregate manufacturing PMI increased to 56.2 in March, up from 55.4 in February, and the highest reading since April 2011. In Germany, the IFO business climate index rose to 112.3 in March (from 111.0 in February), the highest level in six years and back towards pre-financial crisis highs. In the United Kingdom, headline inflation increased 0.7% in February, lifting annual inflation to 2.3% year-on-year, which is the highest inflation rate since September 2013.

China

China’s official manufacturing PMI rose to 51.8 in March from 51.6 in February, higher than economist expectations, and the highest level in five years, suggesting that the world’s second largest economy is gathering momentum.

Asia Region

In Japan, real household spending fell 3.8% year-on-year in February, showing Japanese consumers are reluctant to spend. This is despite the unemployment rate falling from 3.0% in January to 2.8% in February.

Australia

In Australia, employment fell by 6,400 jobs in February which was below expectations and the unemployment rate increased to 5.9% from 5.7%. The total number of hours worked slumped 1.2% over the month suggesting that there is some excess capacity in the labour market which is holding down wages growth.

To read the full update click here.