The Pulse

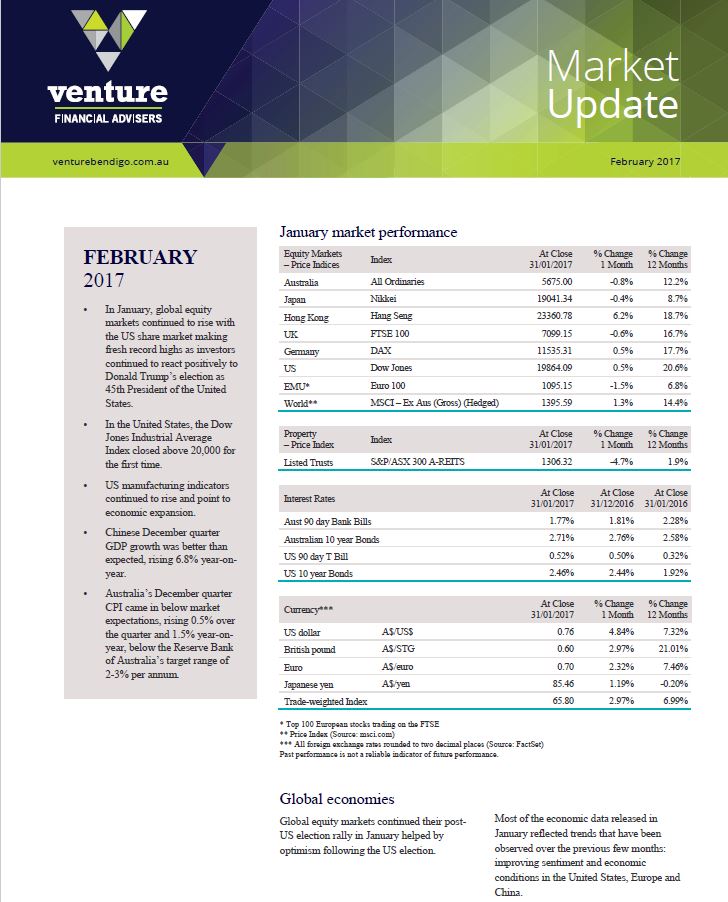

- In January, global equity markets continued to rise with the US share market making fresh record highs as investors continued to react positively to Donald Trump’s election as 45th President of the United States.

- In the United States, the Dow Jones Industrial Average Index closed above 20,000 for the first time.

- US manufacturing indicators continued to rise and point to economic expansion.

- Chinese December quarter GDP growth was better than expected, rising 6.8% year-on-year.

- Australia’s December quarter CPI came in below market expectations, rising 0.5% over the quarter and 1.5% year-on-year, below the Reserve Bank of Australia’s target range of 2-3% per annum.

Global economies

Global equity markets continued their post-US election rally in January helped by optimism following the US election. Most of the economic data released in January reflected trends that have been observed over the previous few months: improving sentiment and economic conditions in the United States, Europe and China.

US

The initial estimate of fourth quarter US GDP growth was a little below expectations –1.9% annualised growth versus expectations of 2.2%. Household consumption and business investment showed reasonably good growth, however, the contraction in net exports detracted from the overall growth rate and was some payback from strong exports in the prior quarter.

Europe

In the Eurozone, the inflation rate jumped to 1.8% year-on-year in January from 1.1% in December. The lift was helped by energy prices which are up 8.1% year-on-year. Excluding energy costs, core inflation was steady at 0.9% year-on-year, in line with market expectations. In the United Kingdom, the legislation to allow Britain to trigger Article 50, the first step in its effort to leave the European Union, was approved by the House of Commons and Article 50 is expected to be triggered in March. Despite the ongoing uncertainty surrounding Brexit, the UK economy continues to perform better than expected with annual GDP growth rising 2.2% in the fourth quarter.

China

In China, December quarter GDP growth was better than expected, rising 6.8% year-on-year. However, the activity indicators in December were mixed.

Asia Region

In Japan, the Bank of Japan (BoJ) left monetary policy unchanged at its January meeting, as expected. The BoJ remains committed to buying Japanese Government Bonds (JGB) each month in an effort to keep the yield on the 10-year JGB at zero.

Australia

In Australia, recent economic data has been a little soft. The unemployment rate ticked up for the second month in a row; from 5.7% in November to 5.8% in December. In addition Australia’s December quarter CPI inflation came in below market expectations, rising 0.5% over the quarter and 1.5% year-on-year. Core inflation was also a little below expectations, rising 0.4% (0.5% was expected) and the annual rate of core inflation remained at 1.6%, which is still well below the RBA’s 2-3% target band.