The Pulse

-

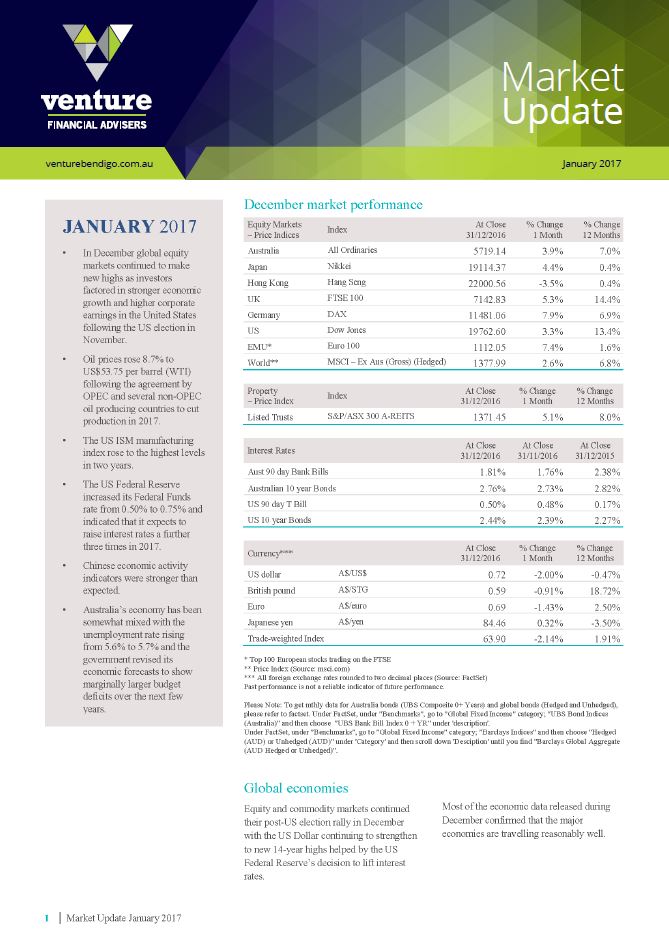

Click here to read the full update In December global equity markets continued to make new highs as investors factored in stronger economic growth and higher corporate earnings in the United States following the US election in November.

- Oil prices rose 8.7% to US$53.75 per barrel (WTI) following the agreement by OPEC and several non-OPEC oil producing countries to cut production in 2017.

- The US ISM manufacturing index rose to the highest levels in two years.

- The US Federal Reserve increased its Federal Funds rate from 0.50% to 0.75% and indicated that it expects to raise interest rates a further three times in 2017.

- Chinese economic activity indicators were stronger than expected.

- Australia’s economy has been somewhat mixed with the unemployment rate rising from 5.6% to 5.7% and the government revised its economic forecasts to show marginally larger budget deficits over the next few years.

Global economies

Equity and commodity markets continued their post-US election rally in December with the US Dollar continuing to strengthen to new 14-year highs helped by the US Federal Reserve’s decision to lift interest rates. Most of the economic data released during December confirmed that the major economies are travelling reasonably well.

Australia

In Australia, recent economic data has been soft with the unemployment rate ticking up from 5.6% to 5.7% and some other labour market measures, such as hours worked and wages growth, also painting a picture of some overcapacity in the labour market. Building approvals, which had been running at close to record levels in 2016, have also contracted sharply, which could point to an earlier-than-expected slowdown in housing construction activity.

US

In a relatively quiet month for economic releases, the limited data that was released showed that the US economy continues to perform in line with recent trends. Consumer confidence moved back up to post-financial crisis highs, unemployment fell to the lowest levels since 2007 and the ISM manufacturing index rose to two-year highs.

Europe

In early December investor attention remained focused on political events, namely the Italian referendum and Austrian Presidential election. However, neither of these events had much impact on markets and attention shifted to the European Central Bank’s decision to extend its asset purchase program for nine months but at a lower rate of monthly purchases.

China

Chinese activity indicators released in December were better than expected and show that fears of a sharp deceleration in growth have been unfounded and this has helped support commodity prices such as iron ore and coal.

Asia Region

In Japan, the sharp depreciation of the Yen against the US Dollar in the past two months has meant that policymakers at the Bank of Japan have become more optimistic on the economy. Despite their more upbeat assessment, economic data has continued to show that the economic growth has remained low.