The Pulse

-

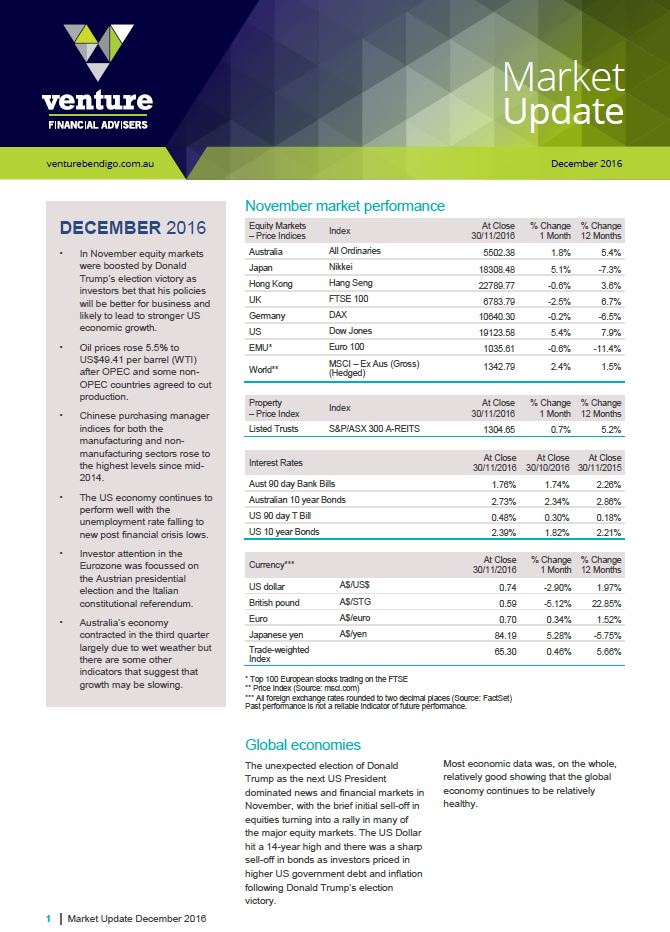

Click here to read the full update In November equity markets were boosted by Donald Trump’s election victory as investors bet that his policies will be better for business and likely to lead to stronger US economic growth.

- Oil prices rose 5.5% to US$49.41 per barrel (WTI) after OPEC and some non-OPEC countries agreed to cut production.

- Chinese purchasing manager indices for both the manufacturing and non-manufacturing sectors rose to the highest levels since mid-2014.

- The US economy continues to perform well with the unemployment rate falling to new post financial crisis lows.

- Investor attention in the Eurozone was focussed on the Austrian presidential election and the Italian constitutional referendum.

- Australia’s economy contracted in the third quarter largely due to wet weather but there are some other indicators that suggest that growth may be slowing.

Global economies

The unexpected election of Donald Trump as the next US President dominated news and financial markets in November, with the brief initial sell-off in equities turning into a rally in many of the major equity markets. Most economic data was, on the whole, relatively good showing that the global economy continues to be relatively healthy.

US

In the US, economic data during the past month has continued to be relatively strong. There was an upward revision to third quarter GDP growth, now estimated at 3.2% annualised, helped by stronger consumer spending and corporate profit growth.

Europe

Although the European economy continues to perform relatively well, with moderate growth rates, falling unemployment and stronger business conditions, investor attention was focused on political events such as the Italian referendum and French elections, which have the potential to destabilise the European Union.

China

In China, economic indicators have continued to paint a picture of an economy that is performing relatively well.

Asia Region

Japanese economic growth continues to be relatively sluggish notwithstanding the significant stimulus from the Bank of Japan. Third quarter GDP growth came in at a relatively disappointing 1.3% annualised rate and retail spending contracted against year-ago levels.

Australia

In Australia, some recent economic indicators have suggested that the economy may be losing momentum. Australia’s third quarter GDP declined 0.5%, partly due to wet weather, but household consumption growth was disappointing.

To read the full market update, click the preview above or read it here.