The Pulse

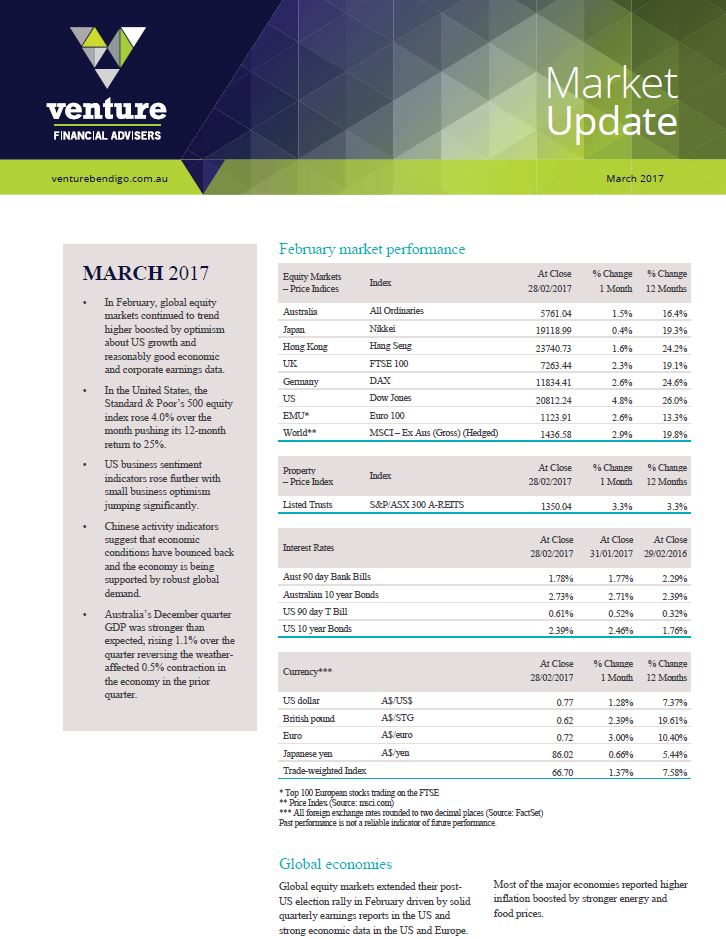

- In February, global equity markets continued to trend higher boosted by optimism about US growth and reasonably good economic and corporate earnings data.

- In the United States, the Standard & Poor’s 500 equity index rose 4.0% over the month pushing its 12-month return to 25%.

- US business sentiment indicators rose further with small business optimism jumping significantly.

- Chinese activity indicators suggest that economic conditions have bounced back and the economy is being supported by robust global demand.

- Australia’s December quarter GDP was stronger than expected, rising 1.1% over the quarter reversing the weather-affected 0.5% contraction in the economy in the prior quarter.

Global economies

Global equity markets extended their post-US election rally in February driven by solid quarterly earnings reports in the US and strong economic data in the US and Europe. Most of the major economies reported higher inflation boosted by stronger energy and food prices.

Australia

In Australia, after a period of softness in economic data, some of the indicators have rebounded, in some cases helped by higher commodity prices. The unemployment rate ticked down from 5.8% in December to 5.6% in January. GDP growth was stronger than expected in the fourth quarter of 2016, rising 1.1% for the quarter and 2.4% year-on-year, beating expectations of a 0.8% rise and helped by strong corporate profits and investment. Australia’s current account deficit was the smallest in 15 years in the December quarter, at $3.9 billion, thanks to a surge in prices for Australia’s exports.

US

In the US, the headline CPI rose 0.6% in January, which was double market expectations and the annual inflation rate rose to 2.5% year-on-year, which is the highest rate since March 2012. In addition, the manufacturing ISM index rose for the sixth straight month to a robust level of 57.7 in February, which was the best reading since August 2014.

Europe

In the Eurozone, the manufacturing PMI for February came in at 55.4, the highest level in six years. In Germany, the harmonised measure of inflation rose 0.7% in February, which was stronger than expected, and this pushed annual inflation to 2.2%, which is the highest annual rate since August 2012. In the United Kingdom, the economy grew faster than predicted in the fourth quarter of 2016, growing 0.7% over the final three months of the year rather than the 0.6% initial growth estimate. UK GDP has now grown for 16 consecutive quarters, despite Treasury forecasts for a steep contraction in economic activity following the Brexit decision.

China

China’s official manufacturing PMI rose to 51.6 in February, which is a three-month high and suggesting that the recent pick-up in global demand is supporting China’s manufacturing recovery.

Asia Region

Japan’s economy still remains stuck in low gear despite zero long-term interest rates. Japan’s GDP in the December quarter rose 0.2% quarter-on-quarter, below expectations of a 0.3% increase, but the fourth consecutive quarter of growth.